Euless auto title loans provide quick cash for car owners using vehicle equity as collateral, with faster processing and flexible plans. To secure a loan, maintain car condition, prepare documents (registration, insurance, ID), and maintain good credit for better terms. Compare options with alternatives like San Antonio Loans.

Euless auto title loans offer a quick solution for emergency funding. If you’re considering one, understanding the process is key. This guide breaks down everything you need to know about Euless auto title loans, from the basics and benefits to preparing your documents efficiently. We also provide top tips to instantly boost your approval chances. By following these strategies, you can secure the funds you need in no time.

- Understanding Euless Auto Title Loans: Basics and Benefits

- Preparing Your Documents for a Seamless Application Process

- Top Tips to Boost Your Approval Chances Instantly

Understanding Euless Auto Title Loans: Basics and Benefits

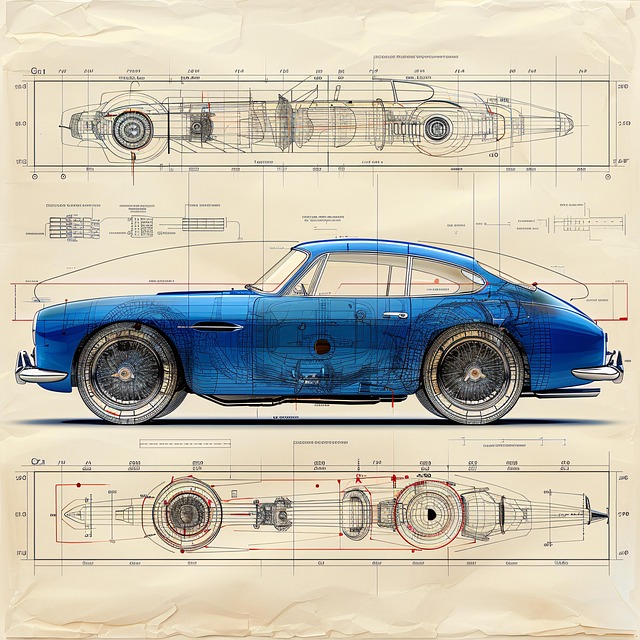

Euless auto title loans are a type of secured lending where individuals can borrow money using their vehicle’s equity as collateral. This innovative financing option is designed to provide fast cash access to car owners who may need immediate financial assistance. Unlike traditional loans that rely heavily on credit checks, Euless auto title loans offer an alternative solution for those with less-than-perfect credit or no credit at all.

The process involves assessing the vehicle’s value and current market conditions to determine the loan amount. Lenders then hold onto a copy of the vehicle’s title until the loan is repaid in full. This secured nature ensures that lenders have recourse if borrowers default, but it also means borrowers must maintain their vehicle’s registration and insurance up-to-date throughout the loan period. Benefits include convenience, speed—typically processing times are quicker than traditional loans—and flexibility, as repayment plans can be tailored to individual needs, making them an attractive option for those seeking fast cash.

Preparing Your Documents for a Seamless Application Process

When applying for Euless auto title loans, having your documents in order is key to a swift and smooth process. Gather all necessary papers such as your vehicle’s registration, proof of insurance, and a valid driver’s license. These documents verify your identity and establish your ownership of the car, which are essential requirements for securing a loan using your vehicle’s title as collateral.

Additionally, ensure that your vehicle is in good working condition and up-to-date with maintenance. Lenders will assess the vehicle’s value to determine the loan amount eligible for San Antonio Loans or Boat Title Loans (if applicable). Keeping your car well-maintained can increase its overall worth and potentially result in a higher loan offer compared to Cash Advance options.

Top Tips to Boost Your Approval Chances Instantly

When applying for Euless auto title loans, there are a few strategic tips that can significantly boost your approval chances instantly. Firstly, ensure your vehicle is in good condition and has minimal damage, as lenders prefer well-maintained cars. This not only increases the loan value but also demonstrates responsible ownership. Secondly, gather all necessary documentation promptly, including proof of income, identification, and vehicle registration. Being prepared with these documents shows that you are organized and committed to the process.

Additionally, maintaining a good credit score can make a world of difference. While Euless auto title loans are often more flexible than traditional loans, lenders still consider your credit history. Keeping your credit score high through timely payments and responsible financial habits can enhance your loan options and potentially secure lower interest rates. Remember, a Title Pawn isn’t always the best option; exploring alternatives like San Antonio Loans might offer more favorable terms, especially if you’re looking for flexible payments to fit your budget.

When considering an Euless auto title loan, being informed and prepared can significantly enhance your application experience. By understanding the basics, organizing essential documents, and implementing top tips for approval, you’re well on your way to securing the funds you need. Remember, a swift and successful application process is within reach when following these expert guidelines for Euless auto title loans.