Euless auto title loans offer quick short-term financing for vehicle owners, using their car title as collateral. Lenders assess vehicle value, set loan amounts, and establish repayment terms while borrowers reclaim ownership upon full repayment. These loans bypass credit checks but carry risks like interest rates, late fees, and repossession. Both parties are subject to legal requirements, including transparency and consumer protection, with Texas laws safeguarding fairness and borrower rights against aggressive collection practices.

“Euless auto title loans have gained popularity as a fast borrowing option, but understanding the legal framework is crucial. This comprehensive guide navigates the intricate details of Euless auto title loans, offering a clear view of rights and responsibilities for both lenders and borrowers under Texas law.

We’ll explore the fundamentals, delving into the legal requirements that safeguard consumer rights in this type of lending. By the end, you’ll be equipped with knowledge to make informed decisions regarding your financial needs.”

- Understanding Euless Auto Title Loans: A Quick Overview

- Legal Requirements for Lenders and Borrowers

- Protecting Consumer Rights in Texas Auto Title Lending

Understanding Euless Auto Title Loans: A Quick Overview

In Euless, Texas, auto title loans serve as a short-term financing option for individuals who own their vehicles outright. This type of loan secures the borrower’s vehicle, typically using the car’s title as collateral. It offers a quick and accessible way to obtain cash in exchange for temporarily handing over the vehicle’s legal ownership. The process involves assessing the car’s value, setting a loan amount, and establishing repayment terms tailored to the borrower’s financial situation. Once the loan is repaid, including any associated fees, the title is transferred back to the borrower, restoring full ownership of their vehicle.

Euless auto title loans are particularly attractive for those in need of rapid funding, such as individuals dealing with unexpected expenses or facing financial emergencies. This alternative financing method bypasses traditional credit checks and offers a simpler route to securing funds. However, borrowers must be mindful of the potential risks, including interest rates, late fees, and the possibility of repossession if repayments are missed. Understanding the title loan process is crucial in ensuring informed decision-making when considering an auto title loan as a temporary financial solution.

Legal Requirements for Lenders and Borrowers

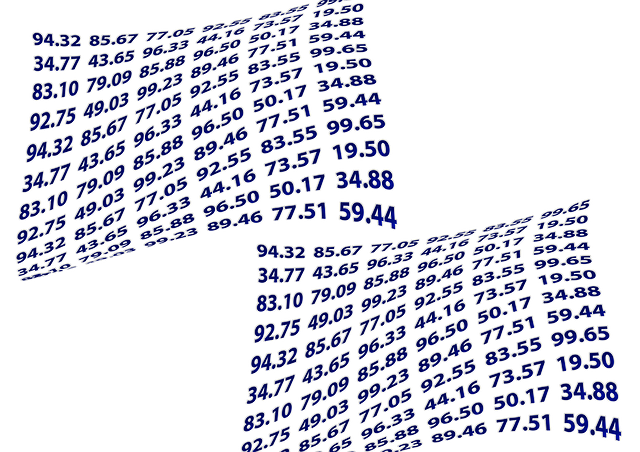

In Euless, like most cities, both lenders and borrowers face specific legal requirements when dealing with auto title loans. Lenders must adhere to strict regulations to ensure fair practices, transparency in pricing, and protection of consumer rights. They need to verify the borrower’s identity, creditworthiness, and ability to repay the loan. This includes checking credit history, income, and the value of the vehicle being used as collateral. The lender must also provide clear terms and conditions, including interest rates, repayment schedules, and any associated fees, ensuring borrowers understand the full extent of their obligations.

Borrowers, on the other hand, are responsible for providing accurate information about their financial situation and the condition of their vehicle. They must ensure that the title to the vehicle is clear and free from any liens or encumbrances. During the title loan process, borrowers should carefully review all documents, understand the implications of defaulting on the loan, and be aware of their rights and remedies in case of dispute. These requirements are designed to safeguard both parties, ensuring a fair loan approval process and minimizing the risks associated with collateralized loans, including potential debt consolidation.

Protecting Consumer Rights in Texas Auto Title Lending

In Texas, consumer protection laws play a pivotal role in ensuring fairness in auto title lending practices, particularly for Euless residents considering Euless auto title loans. These laws are designed to safeguard borrowers’ rights and prevent predatory lending by requiring lenders to adhere to strict guidelines. For instance, loan approval processes must be transparent, revealing all fees and interest rates upfront. Lenders cannot engage in deceptive or misleading practices, ensuring consumers understand the terms of their boat title loans or other vehicle collateral agreements.

Moreover, Texas regulations provide borrowers with the right to repay the loan without additional penalties or harassment, offering some protection against abusive collection tactics. These protections are essential as Euless auto title loans can be a double-edged sword; while they offer quick access to cash, the risk of defaulting on these loans is high due to their secured nature. Awareness of these consumer rights empowers individuals to make informed decisions and navigate the loan process securely.

Euless auto title loans can provide a quick financial solution, but understanding the legal framework is crucial. By knowing the rights and responsibilities of both lenders and borrowers under Texas law, consumers can navigate this type of loan securely. Protecting consumer rights ensures fair practices in the Euless auto title loan industry, empowering individuals to make informed decisions regarding their vehicle’s equity.